Owning your own home has been part of the “American Dream” for years. The pride of ownership and sense of belonging somewhere have been strong factors in motivating over 60% of all households to own their own home. In addition, there can be true financial rewards of home ownership. But, not always.

In a strong economy, demand for housing pushes up the prices people are willing to spend. These rising values have enabled many to reap large profits when they sold their homes. However, home values do not always appreciate and certain areas can be hit hard when a slow down in demand occurs. In 2007 and 2008, the values of homes in many areas fell dramatically. The important thing to remember is that real estate values can decrease as well as increase.

If you plan to stay in an area only a short period, renting may be economically advantageous. The costs of buying a house (realtor’s commission and closing costs), moving (hiring a mover or renting a truck) and getting a mortgage (points and loan origination costs) can add up. If the value of the home has not risen by that total when you are ready to sell, you will end up losing money.

If you have a great apartment and a great deal on rent, it may be very difficult to own the home you want at anything close to your current costs.

If the value of the home you buy goes up, you can profit in a leveraged way. Let us assume you buy a home for $150,000 with a $25,000 down payment and then sell the home for $175,000 (after all costs). Your cash proceeds would be $50,000, or a doubling of your actual cash investment. In other words, the home appreciated about 17% and you made 100% on your money. Remember that leverage works in reverse if prices fall.

There may be tax advantages with owning your home. You should consult a tax professional to discuss.

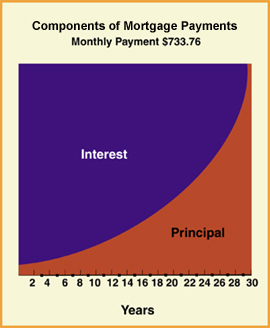

You build up equity in your home as you make mortgage payments. Every mortgage payment you make includes interest and principal repayment. Over time, the principal repayment reduces the remaining amount you owe. In the first few years, most of your payments will be interest. It is in later years that your equity build-up really takes hold. Here is a chart showing how your mortgage payments slowly convert from mostly interest to mostly principal over the life of a 30-year mortgage. You can also try our Loan Comparison Calculator to see how different loans stack up against each other.

Home ownership provides financial flexibility. Your home may be the most valuable asset you own. It can serve as a reflection of your financial stability and it can even be a source of collateral for other borrowing. With a home equity loan, you essentially are pledging the equity in your home for additional borrowing. Home equity loans can be a low cost way of consolidating any other debts you have, perhaps at a lower interest rate and probably get some income tax benefits along the way.*

If you are like millions of others, owning your own home is a primary financial and lifestyle goal. The pride of ownership and the financial rewards are attractive. Just make sure you understand that there can be some downsides before you make the decision and, when you’re ready to discuss financing, contact the Mortgage Team at Peoples Bank in NC.